Two

major payments technologies are coming to the

As

these two approaches come forward at the same time, they have caused

considerable concern and confusion among merchants and issuers. Facing a

market-driven imperative around NFC (mobile commerce is hot!) and a

security-driven imperative around EMV (counterfeiting magstripe cards is

too easy!); merchants in particular are confronted by critical choices

regarding their payment acceptance systems. Merchants operate in the

real world of existing payment infrastructure and have committed massive

investments into that infrastructure.

The

twin technologies of EMV and NFC are especially important to large

merchants as they plan for new products and payment acceptance systems

in a world that is increasingly homogeneous, where customers travel

between regions and expect a consistent consumer experience. The payment

step in the transaction cycle is a critical element of that overall

experience. Of course, layered into the customer experience is concern

for payment security and PCI compliance.

EMV

alone is a significant upgrade to the

This

Payments Trends update answers key questions around EMV’s arrival in the

EMV is

a payment security approach based on smartcard technology that adds

dynamic data to the transaction stream that, unlike standard static

magstripe card data, renders replay of payment transactions impossible.

More important, because every card contains its own microprocessor chip

(that’s why it is called a smartcard), EMV cards are impossible to

counterfeit economically.

While

improvements to magstripe security exist, EMV is the technology that the

payment card brands have chosen to stop card counterfeiting. The

organization responsible for development of EMV standards is EMVCo, a

consortium owned by MasterCard, Visa, AMEX and JCB. EMV is now in wide

global deployment.

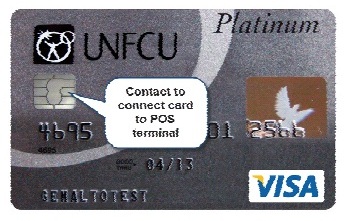

An EMV

card is exactly the same size and thickness as a standard magstripe card

(see Exhibit 1). An EMV card is not swiped like a magstripe card. It is

inserted into a slot on the P05 terminal. On the face of the card is a

metal contact. When inserted, the contact connects the card to the

terminal and the two devices can communicate. Of course, almost all EMV

cards also have a magstripe for use at terminals that haven’t been

upgraded to EMV.

Exhibit 1: Contact EMV Card

EMV also supports contactless payments. A card capable of both contact

and contactless transactions is called a dual interface card. A dual

interface card can be either tapped at the P05 terminal or inserted into

the EMV card reader. In

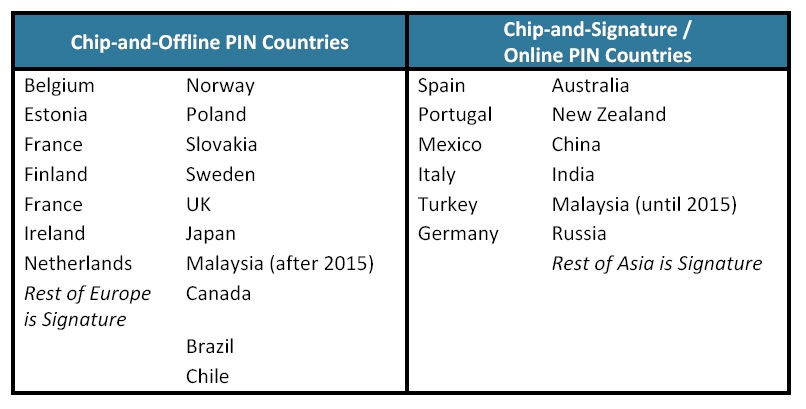

EMV

cards can be deployed for online and offline authorization. Online

authorization uses a process similar to our magstripe authorization

process today where the transaction is verified immediately via an

online connection to the card issuer. Offline authorization is

authorization between the card and the acceptance device, without online

authorization. Offline authorization is called chip and PIN. The PIN

unlocks the card. In many markets, a PIN is used for credit transactions

as well. The choice of whether to use offline authorization generaHy

runs on a national basis. Depending on the issuer and/or the merchant’s

preferences based on transaction type and size, the cardholder may or

may not need to enter a PIN.

Given

that virtually 100% of

EMV is

a global standard. The

Exhibit 2: Online and Offline PIN Countries

The

venerable magstripe has served the payment card well for decades,

enabling untold numbers of electronic transactions. But the magstripe is

no longer able to fend off fraudsters armed with low cost magstripe

readers, card duplication gear and Internet-sourced card data. As those

fraudsters have proven over and over, it is simply too easy to create

counterfeit payment cards.

The

result has been an outbreak of card skimming that has cost merchants,

card issuers, and consumers millions. With most of the developed world

now using EMV to prevent counterfeit card fraud, card fraud is migrating

more and more to the

EMV

will protect against three issues when compared to magstripe:

1.

Counterfeit cards. EMV cards are virtually impossible to copy.

2.

Skimming. Because each transaction is unique and cards cannot be

economically counterfeited, skimming an EMV card is not worthwhile.

3.

Offline interceptions – “man in the middle” attacks – are thwarted

because each transaction contains unique, encrypted data that is of no

use to the fraudster.

While

it has been anticipated for years, it appears that the

To

move the payments ecosystem — issuers, acquirers and merchants — Visa

announced three separate programs:

1.

Technology Innovation Program (TIP).

The TIP program allows merchants to skip their annual Visa PCI

compliance validation once 75 percent of their Visa transactions are

originated on chip-enabled (EMV compliant) POS terminals. The U.S. TIP

program goes into effect on October 1, 2012. Qualifying P05 terminals

must accept both contact and contactless chip cards and contactless

transactions from NFC equipped mobile devices. Visa’s TIP program does

not eliminate a merchant’s PCI requirements, just the validation once

three quarters of Visa transactions originate from EMV-capable

terminals.

2.

Merchant Acquirers Get Ready.

By April

1, 2013, acquirers must be ready to process the cryptographically

generated dynamic data associated with each EMV transaction.

3.

Merchant Get Ready — Liability

Shift. After

October 15, 2015, merchant acquirers will be responsible for any

counterfeit or fraud losses on a transaction if a cardholder with an EMV

card must use the magstripe on that EMV card because the merchant does

not have an EMV-capable POS terminal. The merchant acquirer is likely

to, in turn, make the merchant responsible for the fraud on that

transaction. This liability shift will be in effect for both domestic

and cross-border POS transactions. Gasoline retailers have another two

years to prepare, given the high cost of upgrading their automatic fuel

dispensers. The phrase “liability shift” is frequently used in

discussions over EMV rollout. The purpose of the liability shift is to

encourage the transition to chip cards. With chip-to-chip transactions,

there is no concern regarding liability shift.

Visa’s

pushing for a comparatively swift EMV rollout in the

What

is MasterCard Doing? To date, the second largest card network is

encouraging the EMV transition only on its ATM business. It is targeting

inter-regional Maestro ATM transactions. But it hasn’t announced any

endorsement for a U.S. EMV rollout.

EMV

issuance in the

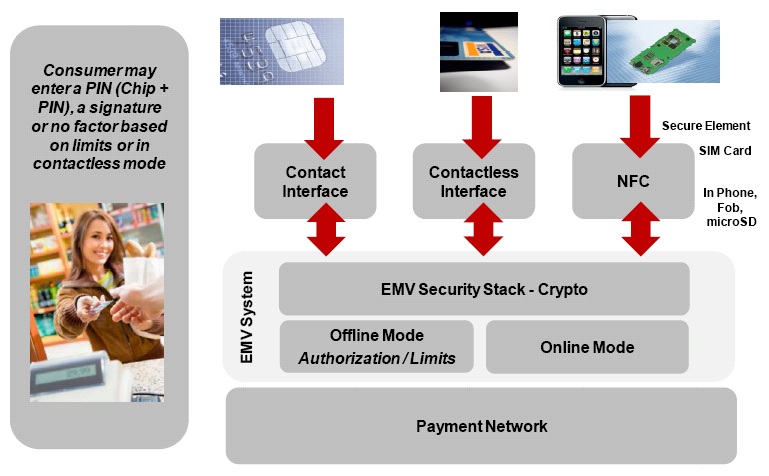

For

many

Exhibit 3: EMV - Multiple Form Factors, Multiple Communications Links

Of

course, expecting all security troubles to be resolved by one technology

is wishful thinking. EMV deployment has suffered from this

“silver-bullet-itis” as well but it is no more a cure-all than card

number encryption. Payments security is about layers of defense because

multiple layers work better. For example, the best ecommerce merchants,

the Merchant Risk Council’s Platinum members, use on average 7.9 tools

to manage their fraud risk. Weaker performers use fewer tools. For point

of sale payments, EMV creates a secure environment by eliminating the

counterfeit and transaction replay risks, a pair of big holes.

ü

To

prepare for EMV and mobile payments, merchants of almost any size

are wise to follow the following recommendations:

If you’re refreshing your terminal estate, buy EMV capable terminals.

Spend the extra $10. Make sure you’re ready to take “chip and PIN”

payments.

ü

If mobile

commerce and payments are on your mind, and they should be. Purchase

terminals that support contact and contactless EMV. Look for

terminals where the contactless capability is built into the terminal

directly, not via an add-on card or external device. That will keep the

cost lower. Buy contactless payment capability if you plan to get more

than two years (and you do) out of your POS terminals. This positions

you for both today’s contactless card payments and for the coming era of

NFC-based transactions.

ü

If you

haven’t already, consider PIN debit acceptance. Because EMV does support

PIN, nearly 100% of EMV terminals include PIN pads. So put those pads,

and the lower cost of debit acceptance, to work.

ü

Drive a

hard bargain. There is going to be heavy competition for the POS upgrade

business.

EMV

does a lot to improve the counterfeit card problem at the point of sale.

By reducing the availability of static data, it will decrease, in the

long run, card-not-present fraud during e-commerce and mobile commerce

transactions. The ability to skim cards goes away. In the short to

medium term, as card present fraud becomes more difficult, card not

present fraud will increase as fraud migrates to the less secure

channel.

As

NFC-equipped smartphones roll out in 2012 and beyond, the EMV shift can

be used to increase payment security for mobile payments using NFC. EMV

provides an important part of the security infrastructure needed for a

wide range of mobile transactions. POS payments and e-commerce payments

can also leverage, with the appropriate hardware, EMV and, in the case

of mobile handsets, the hardware is there.

With

both of these payment technologies arriving at the same time, the smart

merchant will plan to support both and take advantage of the security

and marketing advantages each offers.